India’s Tariff System: Balancing Protection and Progress

A tariff is basically a tax that the government adds to goods coming into or going out of the country—kind of like a price tag for crossing the border. In India, tariff system play an important role in shaping business policies, protecting domestic industries, generating government revenue, and affecting international economic relations. As a developing economy with an increasing manufacturing base and strategic trade interests, India uses a structured tariff system to manage its global trade engagement.

Types of tariffs system in India

India follows a multi-level tax structure, which can be widely classified into the following categories:

1. Basic Customs (BCD):

This is the standard duty imposed on imported goods. The rates are specified under the Customs Tariff system Act, 1975, and vary in products.

2. Counterwelling Duty (CVD):

Equal on equal household items, CVD is applied to Indian manufacturers to level the playground when imported goods are subsidised by the exporting country.

3. Dumping duty:

It is deployed to protect Indian industries from goods that are exported to India at wrong prices, damaging local producers.

4. Safe Duty:

A domestic industry was temporarily deployed to protect them from a sudden increase in imports.

5. Integrated Goods and Services Tax (IGST):

Applicable to all imports in India, IGST is equal to GST that attracts household items.

Tariff system structure and rate classification

India’s tariff system rates have been structured in a Harmonised System (HS) with classification codes for thousands of goods. Tax rates vary widely based on the product category, which ranges from 0% to 100% in some sensitive areas such as agriculture, automobiles, and alcohols.

For example:

- There are high tariffs system (up to 70–80%) on agricultural commodities like wheat and rice to protect Indian farmers.

- Industrial goods, such as machinery, contain relatively low tax (about 7.5%-10%) to support Makein India and attract foreign components.

- Luxury goods such as imported cars and alcohol often face import duties of 60% or more.

Objectives of tariffs in India

Revenue Creation:

Tariff system is a significant source of revenue for the Indian government, particularly in sectors where domestic alternatives exist.

Domestic industry defence:

High Tax shield local manufacturers and farmers from foreign competition.

Encouraging local manufacturing:

Under the self-reliant India (self-sufficient India) campaign, tariff system have been adjusted to promote indigenous production.

Regulating business deficit:

India uses tariff system to control excessive imports and reduce the current account deficit.

Read also – https://bhanukakkar.store/terrorism-in-kashmir-analysis/

Impact on the Economy of India

While tariffs are extremely beneficial for developing local businesses, excessive protectionism can ultimately sap competitiveness from products, resulting in higher prices for consumers and a fragility in international trade relations. An example is high import duties on electronics and mobile parts. This has, at least in part, caused these industries to lag behind in rapid technological innovation, and their costs have been raised by the advantages of the fundamental sector in India.

On the other side, however, targeted taxes have been successful in strengthening particular sectors—steel, for instance, or pharmaceuticals or textiles. As a country, India is placing growing emphasis on FTAs, free trade agreements, and bilateral trade negotiations, resulting in a more balanced approach that includes reduced tariffs but still protects core industries.

What has happened recently?

In recent times, India made several tariffs system that included:

- Increasing taxes on non-essential imports, i.e., toys, electrical appliances, and footwear.

- Reducing duties on capital goods and raw materials to increase manufacturing.

- Production Linked Incentive (PLI) schemes made greater investments alongside taxes in increasing domestic output.

- Trade agreements with countries like the UAE and Australia for duty-free (or very low duty) access for some products have also gained traction.

Conclusion

Tariffs in India are adaptable economic policy tools of evolving rates and structures responsive to domestic requirements and international trends. As India develops as a significant global player, it is essential to implement a balanced tax protection regime with openness to international trade for sustainable development. Stable taxes that are transparent, consistent, and support industry enable India to respond to its objectives and requirements for economic resilience and global competitiveness.

FAQ: India’s Tariff System

1. What is a tariff?

A tariff is a form of tax or duty imposed by the government on imported or exported goods. It’s a tool used to regulate trade, protect domestic industries, and generate revenue.

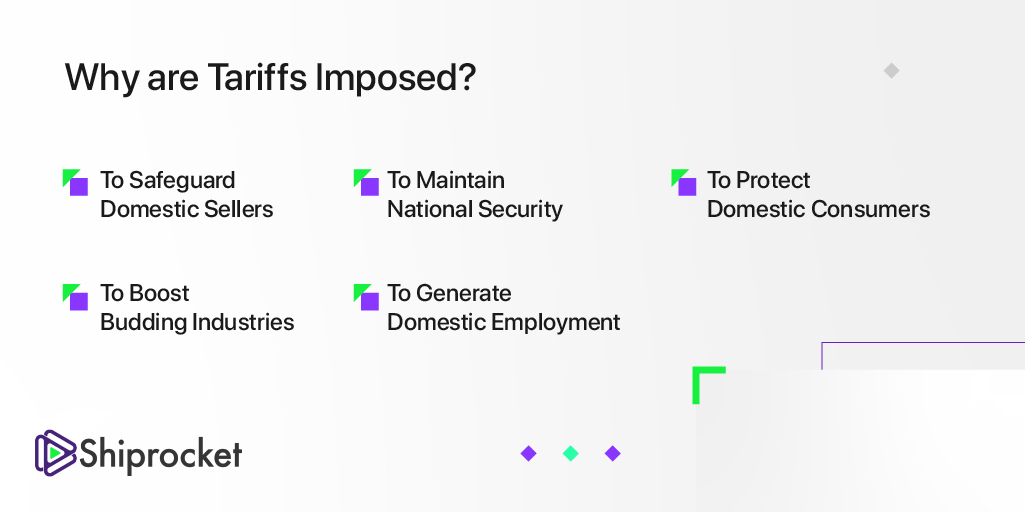

2. Why does India impose tariffs?

India imposes tariffs system for several key reasons:

- To protect domestic industries from foreign competition

- To encourage local manufacturing (especially under initiatives like Make in India)

- To regulate trade deficits

- To generate revenue for the government

3. What types of tariffs are used in India?

India uses several types of tariffs:

- Basic Customs Duty (BCD): Standard duty on imported goods

- Countervailing Duty (CVD): To counter foreign subsidies

- Anti-Dumping Duty: To prevent goods sold below market price

- Safeguard Duty: Temporary protection from import surges

- Social Welfare Surcharge: Additional charge on imported goods

4. How are tariff rates decided in India?

Tariff rates in India are determined by the Ministry of Finance, guided by international trade commitments, domestic industry needs, and recommendations from Directorate General of Trade Remedies (DGTR).

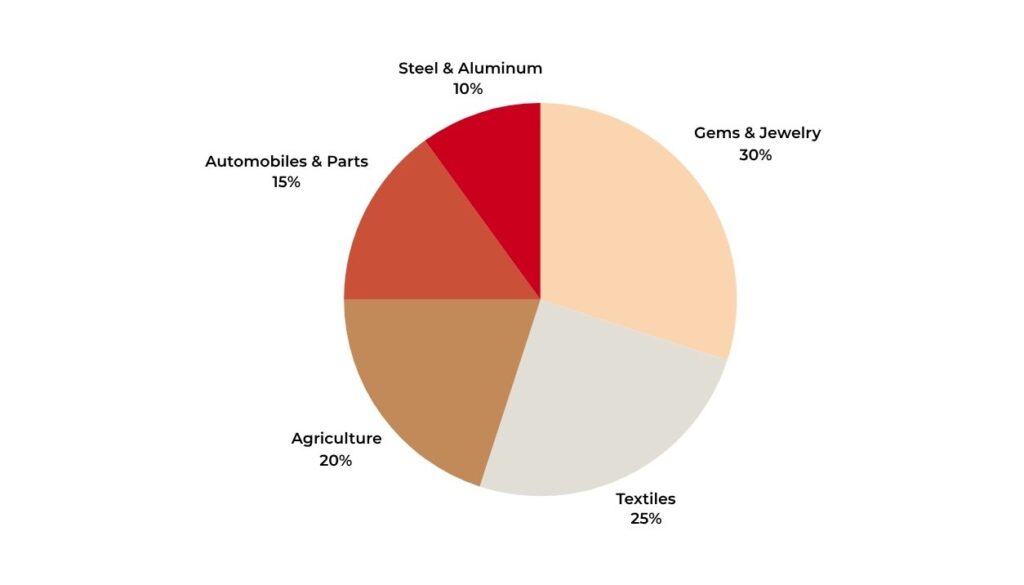

5. Which sectors have high tariffs in India?

Sectors with relatively high tariffs include:

- Agriculture and Dairy Products

- Automobiles and Auto Parts

- Electronics and Mobile Phones

- Textiles and Apparel

Post Comment